Payment terms for tax accounts

Several payment methods are available for paying your tax bill; however, it is important to allow a transmission time to meet the due date.

Electronic payment from your financial institution

- Choose the supplier “Village de Senneville”

- Enter the 10-digit file number that appears on your tax account stubs

Participating financial institutions:

- Laurentian Bank

- National Bank

- Scotiabank

- TD Bank

- BMO

- CIBC

- Desjardins

By mail

Payment methods accepted:

Personal cheque, certified cheque, bank money order or postal money order (payable to Village de Senneville)

- Write the file number of the tax account(s) to be paid on the back of the cheque.

- It is recommended that you send, in the same envelope, post-dated cheques for additional payments with the corresponding payment stubs.

- The payment of your tax bill is recorded on the day it is received by the municipality, and not on the day of the postmark.

Mail everything to:

Village de Senneville,

35 Senneville Road

Senneville, Quebec H9X 1B8

** Please allow sufficient time for your payment to reach us.

Through the mail chute

The mail slot is located at:

35 Senneville Road

Senneville, Quebec H9X 1B8

In person at the Town Hall

Payment methods accepted:

- Cash

- Debit card

- Personal cheque, certified cheque, bank money order or postal money order (payable to Village de Senneville)

** We do not accept credit card payments.

Business hours:

- Monday to Thursday: 8 a.m. to 12 p.m. and 12:45 p.m. to 4:30 p.m.

- Friday: 8 a.m. to 12 p.m.

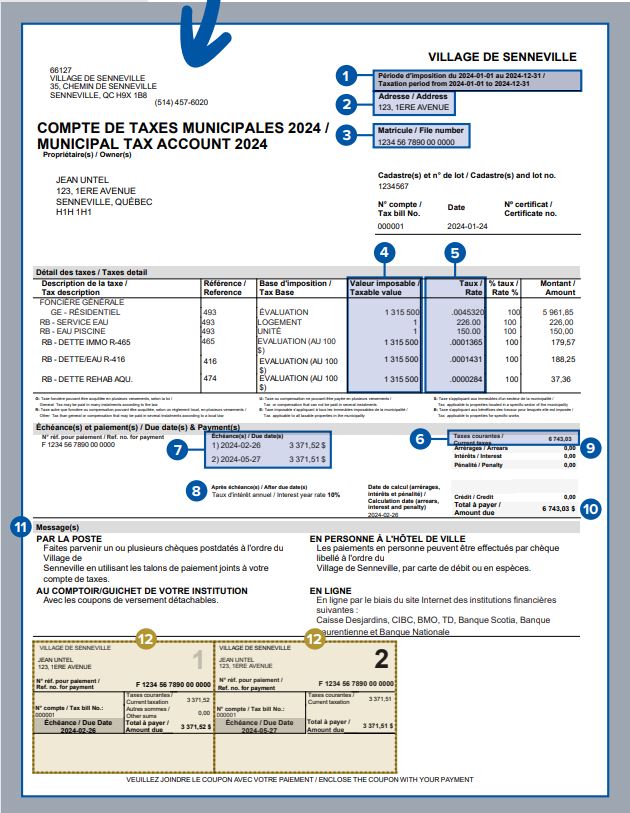

Understanding your municipal bill

- Tax year

- Address of building concerned by taxation

- File number:

Unique number associated with your property - Assessed value:

Value on which property taxes are calculated - Rate: Property tax rates and pricing by building:

this rate varies from year to year - Total: Total amount of taxes for the taxation year shown on the statement

- Due dates: Due dates for the two (2) required payments

- After due date: Value of interest charges as of the date of the first payment on the balance due, if not paid by the due date

- Arrears: Balance of transactions prior to the printing date of the current tax account

- Total payable: Amount payable including taxes for the current year, arrears and interest

- Messages: Section reserved for important messages from the Village of Senneville

- Reference number for payment (file number)

Orange rectangle: Payment stubs (2) – Use one stub per payment, according to the due dates indicated on each one.